This infographic in Fast Company got me thinking: Is China the answer to African resilience?

Anyone worried about climate change would be agog at what this map says: That Africa (including, it looks like, even the African Sahel, based on the arrow) will be China’s breadbasket! But other maps of Africa, suggest this might be a fantasy ND-GAIN’s data (as well as that of e.g. Maplecroft) suggest that Africa is vulnerable, including and especially in its food sector.

But what if African economic development changed these risk maps? Then, could we see the sort of hope illustrated in that fantastic Fast Company arrow?

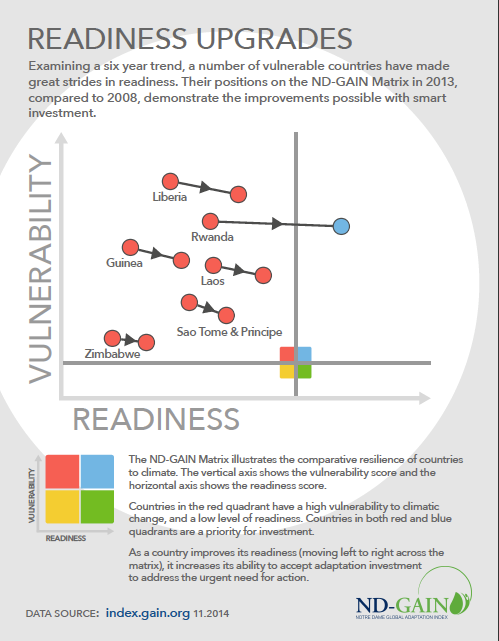

GAIN identifies two types of countries vulnerable to climate change – those ready for investment (due to their economic, social and governance perspectives) and those that are not. My audience often asks me, how will those countries unready for adaptation investments become less vulnerable? China, seemingly, is providing that answer.

The Economist reported on the Centre for China & Globalization and National Bureau of Statistics numbers, which showed that China’s direct investment flows are edging toward a slight majority of outflows this year, with around $130B in outflows and about $120B in inflows projected, and Africa is one recipient of that outbound investment. The story we know well is that state-owned enterprises are searching for resources in Africa. And mining is a part of this story. But private Chinese firms also are pioneering in the African marketplace, as Peter Orzag explains in Bloomberg.

Earlier this year, Reuters reported that China will extend over $12B in aid to Africa in future years.

Earlier this month, as China’s leader wrapped up a premier tour of strong handshakes and lavish gift-giving around the Pacific following on APEC, I grew hopeful that China turns from a BRIC into a brick-builder that helps African countries and other emerging economies continue to build the foundation of their resiliency.

Joyce Coffee, Notre Dame Global Adaptation Index Managing Director, opens last year’s ND-GAIN Annual Meeting.

Joyce Coffee, Notre Dame Global Adaptation Index Managing Director, opens last year’s ND-GAIN Annual Meeting.

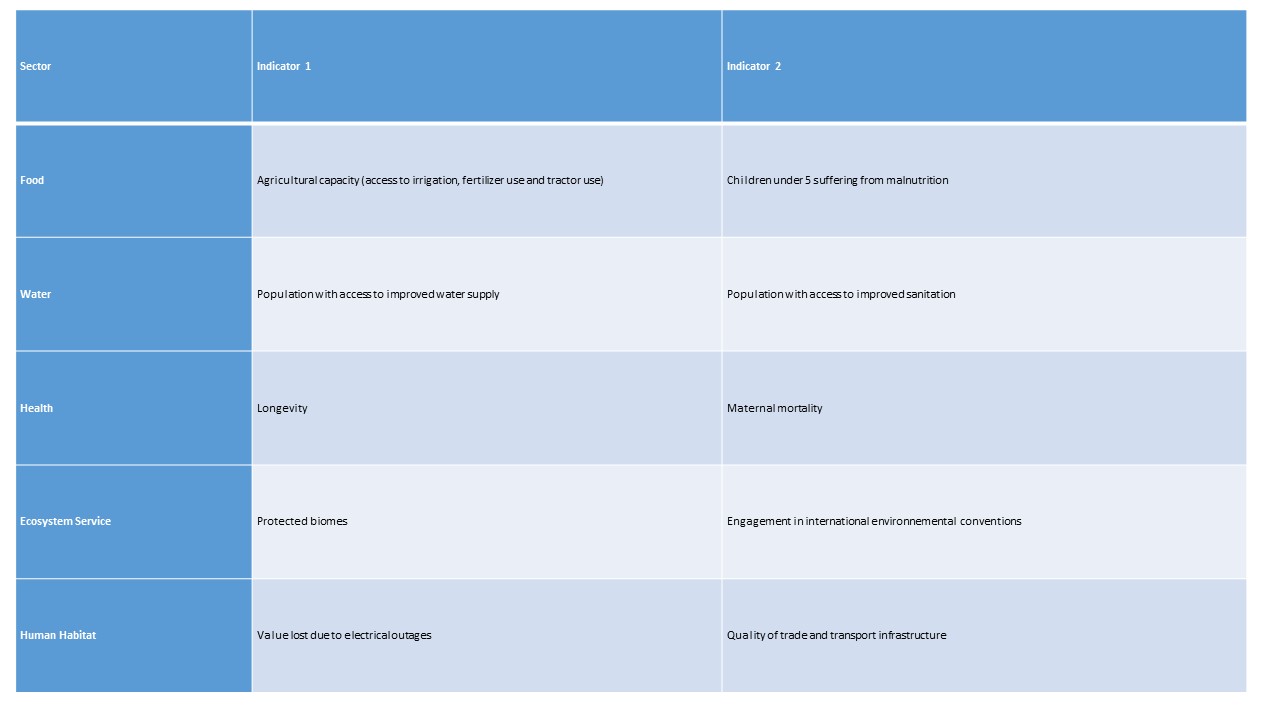

To measure countries’ resilience to rebound from adverse impacts of climate change, ND-GAIN focuses on the adaptive capacities of five sectors that provide communities with life-supporting assets and social services:

To measure countries’ resilience to rebound from adverse impacts of climate change, ND-GAIN focuses on the adaptive capacities of five sectors that provide communities with life-supporting assets and social services: