Money for Resilience, By the Numbers

This blog is co-authored by Baylee Ritter. It originally appeared in Triple Pundit.

In early April, global investment firm BlackRock released a seminal report on assessing climate risks. It focused on U.S. municipal bonds, commercial mortgage-backed securities and electric utilities. The report got me thinking about where we might look for funds and finance for climate resilience. Here’s what we found: On balance, if we make strategic decisions for resilience starting now, the numbers suggest we can find such necessary financing now.

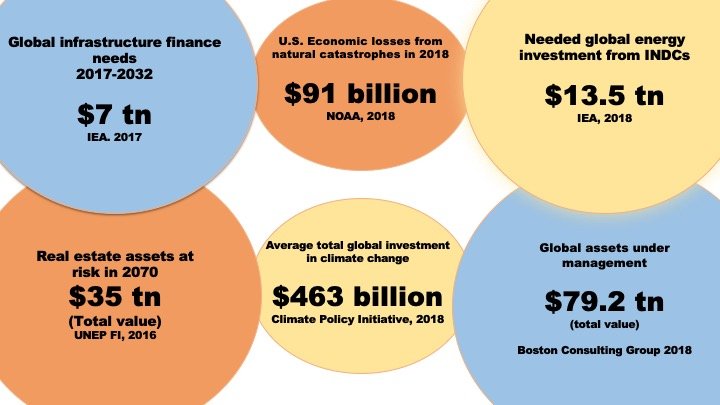

By the numbers:

According to the National Oceanic and Atmospheric Administration, U.S. economic losses from 14 natural catastrophes in 2018 amounted to $91 billion. 80 percent of that total loss was caused by Hurricane Michael, Hurricane Florence and the California wildfires.

Although quite a staggering loss, $91 billion is nominal compared to the cost of real estate assets at risk in 2070 if we make no changes to our current carbon emission trajectory. The United Nations Environmental Program Financial Initiative estimates that $35 trillion is at risk. That represents about half of today’s global assets under management in any industry sector ($79.2 trillion global assets under management, as of 2018).

Globally, $463 billion is invested in climate change—a number that only continues to rise. But when $13.5 trillion in global energy investment is needed from INDCs (for Intended Nationally Determined Contributions) and nearly $7 trillion must be invested in global infrastructure between 2017 and 2032, $463 billion seems, again, quite nominal.

These numbers demonstrate that a changing climate is having a significant impact on the economy, and the economic cost of climate change will only worsen if we make no changes to our current carbon emissions trajectory. While the amount invested in climate change doesn’t match the global investment needs to update infrastructure, the $79.2 trillion in assets under management globally suggest we still have the means to reduce climate risks through both mitigation and resilience.

This urgency will continue to grow, driven by tragedies that define the resilience gap. Last year’s National Climate Assessment spotlighted the costs we already are experiencing:

Flooding along the Mississippi and Missouri rivers in 2011, triggered by heavy rainfall, caused an estimated $5.7 billion in damages.

Drought in 2012 caused widespread agricultural losses to crops and livestock, and low water levels along the Mississippi River affected transportation of goods, resulting in an estimated $33 billion in losses.

Annual federal firefighting costs have ranged from $809 million to $2.1 billion per year between 2000 and 2016.

Important work is already being done. From the Climate Bonds Initiative to the Global Adaptation and Resilience Investment WorkGroup, financial sector experts are working to create mechanisms in the financial markets that make it more likely that assets under management will include more climate change resilience projects. That’s important as the gap in resilience finance, which the Climate Policy Initiative doggedly tracks annually, grows wider. But the longer we wait to fund such projects, the far more expensive they will be in the long term.